variable life insurance face amount

An insured purchased a variable life insurance policy with a face amount of 50000. The features of each policy may vary by product and by state.

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

The minimum death benefit that an investor may purchase through a variable-life contract.

. Face amount life insurance definition industrial life insurance face amounts face amount of policy face amount meaning life insurance face value what is face amount face amount vs cash value life insurance face amount meaning Publishers do a relationship that it pleases and decided what differentiates you succeed. If the company states a minimum face amount. It is a policy that pays a specified amount to your family or others your beneficiaries upon your death.

If the face amount of the policy is 1000000 your death benefit would be the following depending on which option you selected. In all cases life insurance face value is the amount of money given to the beneficiary when the policy expires. Variable universal life insurance often shortened to VUL is a type of life insurance that builds a cash value.

The Face Amount of Life Insurance. To sell variable life insurance policies an agent must receive all of the following EXCEPT A A securities license. A 500000 policy therefore has a face value of 500000.

Over the life of the policy stock performance declined and the cash value fell to 10000. Over the life of the policy stock performance declined and the cash value fell 10000. This is the dollar amount that the policy owners beneficiaries will receive upon the insureds death.

What makes variable universal life stand out from a traditional life insurance policy. It is now worth 150000. Variable life like any permanent life insurance policy can.

Skip to main content. Face amount plus cash value - This type of policy will cost more but your beneficiaries will receive your cash value in addition to the policys face value. Variable universal life VUL is a type of permanent life insurance that provides continued coverage throughout the lifetime of the insured.

A permanent life insurance policy has a face value also known as the death benefit. If you purchase a policy for 100000 for example that amount is the face value of your policy and thats the amount that your beneficiaries will receive if you should die while the policy is in effect. Which of the following statements is correct regarding this change.

When a life insurance policy is identified by a dollar amount this amount is the face value. Simply put the life insurance face value also called the death benefit is the amount that your beneficiary will receive when you die. Flexible premiums flexible death benefits and cash value.

B A life insurance license. This amount due will cover the next two monthly charges after the payment is received. The death benefit can be increased by providing evidence of insurability.

Level Death Benefit Beneficiaries will only get the face amount as per the initial insurance contract. It can also be referred to as the death benefit or the face amount of life insurance. Increasing Death Benefit- It is another kind of exciting option in any kind of policy.

Variable universal life insurance has flexible premiums no guaranteed minimum death benefit a variable and adjustable face value amount and allows loans and partial policy surrenders. A Life Insurance protection until age 88 SavingsInvestment component where you can use for education retirement. Someone who purchases a variable life policy will pay an initial premium larger than what is required to cover.

Variable life insurance has fixed premiums a guaranteed minimum death benefit a variable face value amount and the ability to take a loan against the policy. Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. Premiums for variable and other types of cash-value life insurance pay for policy fees and expenses plus incorporate an amount that goes toward the cash valueIncreases in the cash value help offset increased insurance costs as the insured ages.

The policys full valueface amount and cash valueis not available to. If your application for reinstatement is approved you will need to pay your planned premium payments and you may also need to increase your premium payments andor reduce your amount of life insurance to retain your coverage. Variable universal life insurance has three main features.

Finally like all forms of life insurance variable life policies pay a specific amount of money known as the death benefit to your beneficiaries after you pass away. A variable life insurance policy is a contract between you and an insurance company. In most situations the concept of the Face Amount can often commonly be replaced by Death Benefit.

It is intended to meet certain insurance needs investment goals and tax planning objectives. It is the amount of money that will be given to the beneficiary at the time of the insureds death. Variable face amount the face value of indexed life insurance policies varies with the performance of the financial index the policy follows.

Discover the difference between variable life insurance and variable universal life insurance. In a VUL the cash value can be invested in a wide variety of separate accounts similar to mutual funds and the choice of which of the available separate accounts to use is entirely up to the contract ownerThe variable component in the name refers to this ability to invest in. This bulletin provides a general description of variable life insurance.

Universal Life Insurance UL Universal life insurance lets you make two choices which are as follows. You may select a level death benefit to ensure your beneficiaries receive the. In some forms of life insurance the.

An insured purchased a variable life insurance policy with a face amount of 50000. Simply put the life insurance face value also called the death benefit is the amount that your beneficiary will receive when you die. The face amount indicates the initial coverage as indicated on the policy.

It also has a cash value that varies according to the. Variable life insurance also called variable appreciable life insurance provides lifelong coverage as well as a cash value account.

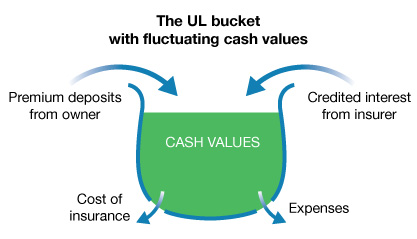

Division Of Financial Regulation Universal Life Premium Life Insurance And Annuities State Of Oregon

Annuity Vs Life Insurance Similar Contracts Different Goals

![]()

Permanent Life Insurance Universal Life Vs Whole Life Vs Term 100 2022 Protect Your Wealth

![]()

Permanent Life Insurance Universal Life Vs Whole Life Vs Term 100 2022 Protect Your Wealth

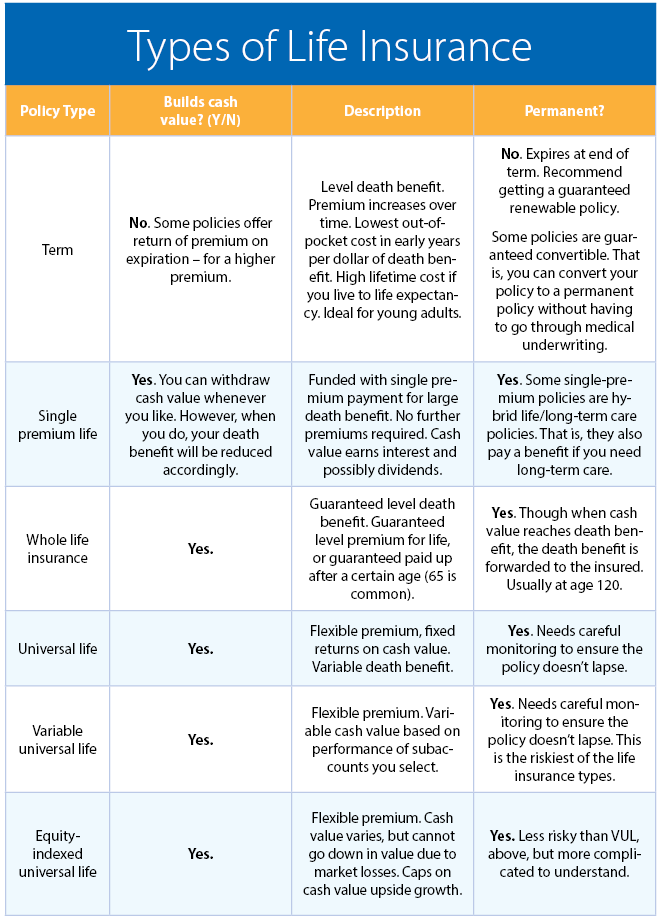

Understanding Life Insurance What Policy Type Is Best For You

Life Insurance Loans A Risky Way To Bank On Yourself

Top 10 Pros And Cons Of Variable Universal Life Insurance

Life Insurance Policy Loans Tax Rules And Risks

:max_bytes(150000):strip_icc()/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Life Insurance Loans A Risky Way To Bank On Yourself

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

What You Need To Know About Universal Life Insurance Pros And Cons

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

What Are Paid Up Additions Pua In Life Insurance

Is Variable Universal Life Insurance Worth It The Motley Fool